Overview of Discovery Bank

Discovery Bank, established in 2019, is South Africa’s first behavioral bank, integrating banking with wellness through its unique rewards program. This digital-first bank offers a range of innovative banking solutions designed to reward customers for healthy financial behavior.

Account Options

Discovery Bank provides a variety of accounts tailored to meet different needs:

Discovery Account:

- Zero Monthly Fees: Offers basic banking services without a monthly fee.

- Vitality Money Integration: Includes access to Vitality Money, enabling customers to earn rewards for good financial habits.

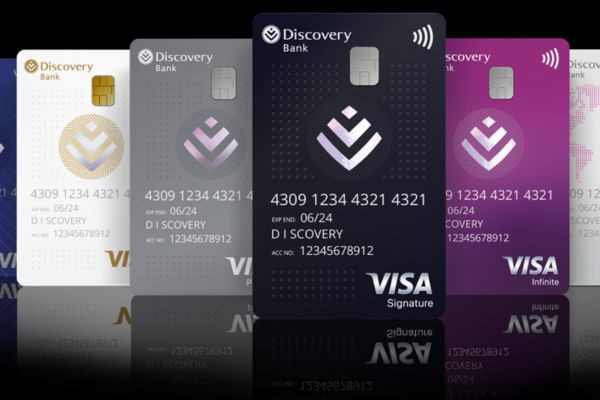

Credit Card Accounts:

- Gold, Platinum, and Black Credit Cards: Each tier offers increasing benefits such as higher rewards, travel perks, and enhanced customer service.

- 55 Days Interest-Free: Up to 55 days of interest-free credit on select transactions.

- Transactional Capabilities: Full banking services including debit orders, digital payments, and salary deposits (Discovery).

Savings Accounts:

- Demand Savings Account: Flexible access with interest rates up to 4.75%.

- Notice Savings Account: Requires a notice period for withdrawals, offering up to 5.50% interest.

- Tax-Free Demand Savings Account: Tax benefits with up to 6.50% interest.

- Fixed Deposit Account: Higher fixed interest rates up to 7.75% for long-term savings (Discovery).

Unique Features and Benefits

Vitality Money Rewards:

Travel and Lifestyle Benefits:

- Vitality Travel: Discounts and exclusive offers on travel, car hire, and accommodation.

- HealthyFood and HealthyCare: Up to 40% cashback on healthy groceries and personal care items.

- Fuel Rewards: Up to 10% back on fuel purchases at select stations and Uber rides (Discovery).

Digital Banking Experience:

- Mobile App: Comprehensive banking services through the Discovery Bank app, including account management, transaction tracking, and goal setting.

- Partner Stores: Cash deposits can be made at partnered stores like Pick n Pay and Boxer for a fee of R19.95 per transaction (Money Gap).

Real-Time Forex Accounts:

- 24/7 Access: Manage multiple currency accounts in real-time through the app.

- Competitive Rates: Access to favorable exchange rates and low fees for international transactions (Discovery).

How to Get Started

Opening an Account:

- Digital Application: Download the Discovery Bank app and complete the registration process, which includes ID verification and a selfie for authentication.

- Card Delivery: Schedule a courier to deliver your bank card, which can be activated via the app (Money Gap).

Account Management:

- Deposits and Withdrawals: Make cash deposits at partnered retail stores and withdraw cash from any ATM offering Visa services. Customers get four free withdrawals per month, with a nominal fee thereafter (Money Gap).

- Financial Tools: Use the app to set financial goals, track spending, and manage savings with tailored advice and insights (Discovery).

Conclusion

Discovery Bank stands out with its innovative approach to banking, rewarding customers for positive financial behavior and integrating wellness into the banking experience. With a range of account options, robust digital tools, and a comprehensive rewards program, Discovery Bank offers a compelling choice for modern banking in South Africa.

For more detailed information, you can visit the official Discovery Bank website here.